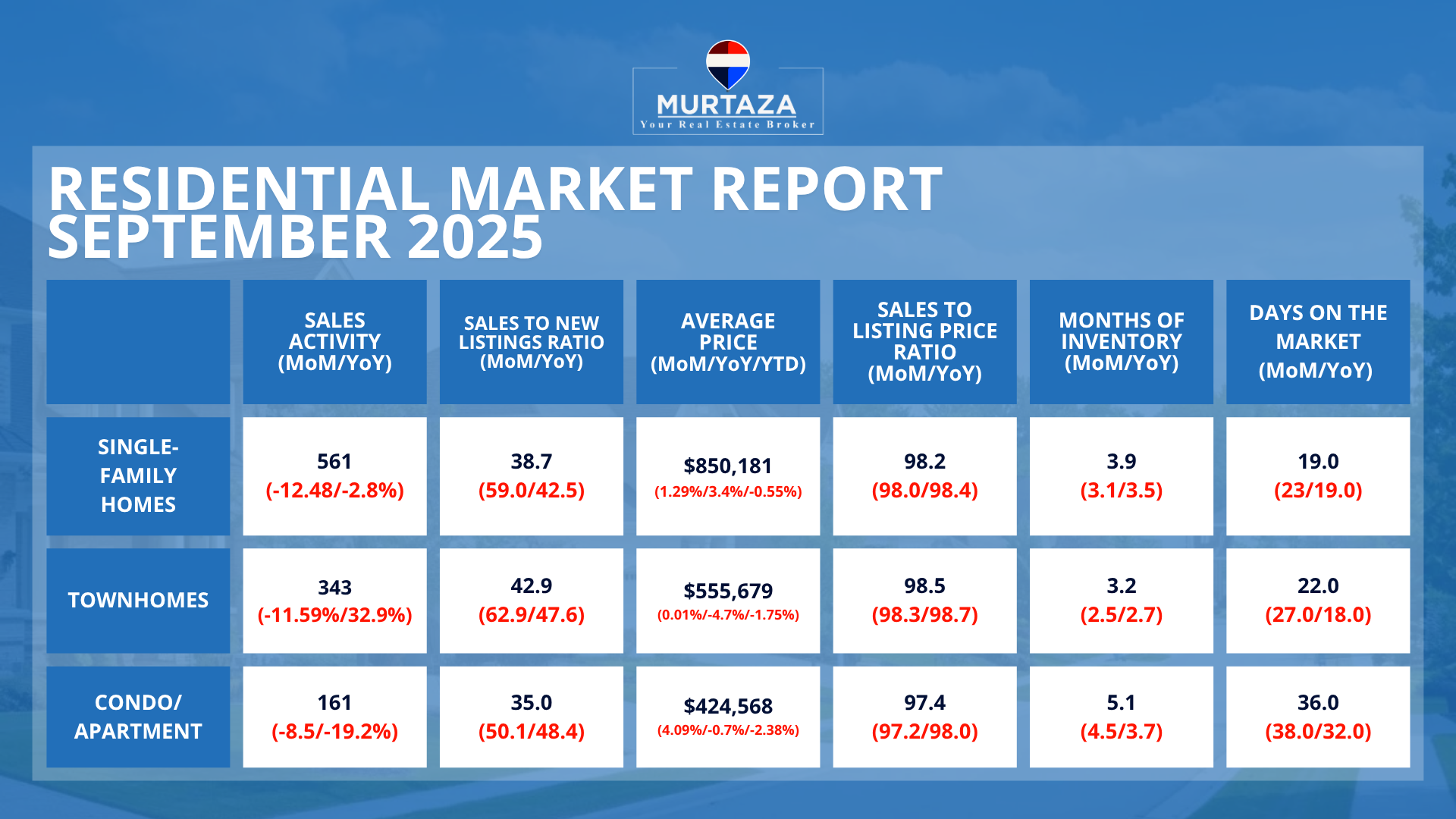

In September, Ottawa saw 1,089 home sales, down 11.9% from August but up 2.4% compared to last year. The average sale price was $690,397, holding steady with only slight monthly (+0.56%) and yearly (+0.3%) increases. Single-family homes averaged $850,181, townhomes $555,679, and condos $424,568. Inventory rose to 4 months, giving buyers more choice, while sellers continued to receive about 98% of their asking price. Homes spent an average of 23 days on the market, quicker than last month.

💰 Economic & Mortgage Outlook

On September 17, 2025, the Bank of Canada cut its key interest rate by 0.25%, bringing the benchmark down to 2.50%.

🔑 What It Means for You:

For Buyers: Lower borrowing costs significantly improve affordability. Expect more competition this fall as sidelined buyers re-enter the market.

For Sellers: With more qualified buyers active, competitively priced homes are likely to see stronger inter

est and faster sales.

For Investors: Financing conditions have improved considerably. Lower rates make multi-unit properties and long-term rental strategies even more attractive.

🏦 In plain terms: The market just became more accessible—this rate cut could be the turning point for fall activity in Ottawa real estate.

📰 Important National News

National – Inflation Watch:

Canadian headline inflation ticked higher to 1.9% year-over-year in August, up from 1.7% in July, according to RBC Economics. While the removal of the carbon tax continues to hold overall CPI lower, slower declines in gasoline prices nudged headline inflation up.

Core inflation (CPI excluding food and energy) held steady at 2.4%, and the Bank of Canada’s trim and median measures stayed close to 3%, showing underlying pressures remain above the BoC’s 2% target.

👉 What it means: Borrowing costs are easing thanks to lower mortgage interest costs, but persistent core inflation signals that the Bank of Canada must tread carefully in its next moves.

🏘️ Neighbourhood Spotlight: Orléans

✨ Why Buyers Love It: Family-friendly schools, riverside parks, and easy access to downtown.

💡 For Sellers: Strong demand for single-family homes keeps the market active.

📈 For Investors: Continued population growth and transit expansion support long-term rental demand.

🔑 Practical Insights This Month

Buyers: Lock in pre-approvals quickly as lenders adjust rates post-BoC decision.

Sellers: Stand out in a busy fall market with strong presentation—staging and photography matter.

Investors: Monitor government housing incentives for multi-family developments.

🎶 What’s On in Ottawa – October 2025

Thanksgiving Bonus Market at Lansdowne – 9 AM to 1 PM, Saturday before Thanksgiving

Haunted Walks of Ottawa – All October

Pumpkinferno at Upper Canada Village – Oct 3–31

📌 What’s Next for Ottawa Real Estate?

The Bank of Canada’s rate cut is already influencing affordability and buyer confidence. Expect heightened activity this fall, with quicker sales and increased competition. Sellers should remain strategic with pricing, and buyers should be ready to act.

📞 Let’s Connect

Whether you’re planning to buy, sell, or invest this fall, I’m here to provide clarity, strategy, and results.

👉 Reach out today for:

A free home value estimate

A buyer’s consultation

An investment strategy session

Sources:

Bank of Canada lowers policy rate to 2½%

Canadian inflation ticked higher in August

Contact:

Murtaza Siddiqui

Broker at RE/MAX Hallmark Realty Group

Email: [email protected]

Phone: (613) 805-1111